SECURING YOUR FUTURE WITH A GOLD IRA

The Individual Retirement Account is a retirement savings scheme that allows individuals to put away a part of their annual income to secure a comfortable retired life. These schemes also allow for tax benefits on such savings with the earnings on select plans being tax-free. There are, however, different types of IRAs – traditional, Roth, SIMPLE (Simplified Incentive Match Plans for Employees) and SEP (Simplified Employee Pension), where each one is associated with specific age and contribution limits, as well as tax liabilities.

Individuals can make use of one or more IRAs to save for their retirement. But as of 2011, prevalent rules capped the total annual IRA contributions at $5,000 for those below 50 years of age, and at $6,000 for those aged 50 and above.

Individual Retirement Accounts allow a great deal of flexibility, depending on the investment options supported by the custodian or trustee who handles the investments on behalf of the individual. Self-directed IRAs allow individuals to choose their own investment avenues. They may choose to invest their funds in stock markets, mutual funds, convertible debentures, bonds or even precious metals.

The Tax Payer Relief Act of the 1990’s has made Gold IRA investing possible for individuals, and include gold or other precious metals in their existing retirement plans if supported by the custodian.

How to Open a New Account

Securing your future with a Gold IRA is a viable investment strategy best handled with professional help, especially trustees or custodians who are experienced in dealing with precious metals. Investors can open a new Gold IRA investing account by submitting the necessary documents to the custodian, along with a storage fee to operate the account.

Gold procured as a part of the scheme will be stored in a remote safe depository after noting the form, denomination and weight of the item. Gold can either be procured as bars or coins. Custodians directly handle procurements on written instructions from the investors. IRS requires that gold procured for gold-backed IRAs be 99.5 percent pure to qualify as valid investments.

Gold IRAs accept only uncirculated coins and bars in tamper-proof packs that have been certified for quality and authenticity; and vetted by approved refiners, ensuring that all Gold IRA investments are justified. U.S. Gold Buffalo coins, American Gold Eagles, Canadian Gold Maple Leafs, Australian Kangaroo-Nuggets and Austrian Philharmonic coins are perfectly acceptable for Gold IRA investing.

Investors may also choose to buy stocks from companies involved in mining gold. Nonetheless, the investment does stand exposed to market fluctuations.

How to Manage the Investment

Individuals can use cash to fund their Gold IRA investments. Of course, being subject to the maximum annual contribution limits.

Alternatively, they may also choose to transfer funds from any existing retirement account; 403(b), 401k or any other retirement savings scheme to a self-directed IRA. Rollover of funds into an Individual Retirement Account is based on individual discretion and is not required to be reported to the IRS, but is subject to certain conditions.

Benefits

• Gold IRA investments serve to preserve and even increase the value of an investment over time, as gold value (or any precious metal) is bound to increase with time, when compared to conventional IRAs.

• Precious metal in IRAs is an intelligent way to diversify investment portfolios, making the most of the tax benefits associated with the Individual Retirement Account. Despite total deferred annual contributions being limited to $5,000 or $6,000; the amount when invested in gold, is certainly bound to offer better yields than Roth or traditional IRA, considering the fact that gold prices have seen a steady rise in the last decade.

• Conventional paper-based IRAs have served generations of retirees. However, the retirement benefits have not been very substantial. Given the bleak economic conditions of today and the rising cost of living, it is prudent to invest in gold and other precious metals.

• Stock market fluctuations and the steady depreciation of the U.S. Dollar are also causes for concern as they tend to erode the net worth of currency-based investments. Prices of precious metals, including gold, are not completely free from fluctuations. However, they tend to remain valuable as they continue to stay in high demand across most industries.

• Gold is used extensively for jewelry and ornamentation purposes, apart from use in electronics, healthcare and cosmetics. It is always possible for business establishments to float additional paper-based instruments; such as stock options, shares or bonds, quickly bringing down the value of these investments.

• Naturally occurring precious metals are limited resources and despite continuous mining activity, there is only a given quantity of such metals present in the world. Ultimately, the demand is eternal and continues to grow, making it impossible to undermine the value of these metals.

IRAs and Tax Implications

Financial advisors are the best individuals to seek advice on the tax implications of various IRAs and they can guide investors in choosing an appropriate retirement plan. Nevertheless, a basic understanding of IRAs will assist investors in making an informed decision and make it easier to follow the process.

Any investment is subject to annual limits as seen earlier. Traditional IRA investments qualify for an annual tax rebate or exemption, based on several factors such as; income, employer participation or marital status. If funds are withdrawn from the account before the investor is 59½ years of age, the withdrawals are bound to attract penalties and tax. Penalty waivers may be allowed in select cases, such as if the withdrawals are used to buy a home or pursue approved higher education courses. Nonetheless, the amount would still incur a tax.

Roth IRAs, on the other hand, do not offer any tax benefits on the contribution, but distributions after retirement are totally free of tax liabilities. Roth IRAs impose income restrictions to qualify for the scheme and may not be suitable for all individuals.

Gold-backed IRAs require that gold is safely stored inside the depository firm until the individual withdraws the gold or cash. Any attempt to take possession of the gold or personal custody of physical metal assets for the distribution of retirement benefits would therefore incur penalties and taxes. Such distribution is also required to be intimated to the IRS.

Transfer of gold from one storage facility to another under the control of a different custodian is permitted, often coming with a charge.

Withdrawals From Gold IRAs

Investors may choose to withdraw either cash or physical gold from their IRAs. Cash, being available after the gold holdings have been liquidated by making a distribution request to the custodian. Distributions are subject to taxes.

It is also possible for investors to take custody of the physical gold from the account while still retaining it as a part of the IRA. This form of transaction is taxed twice – once when the physical gold is delivered to the investor, and later again when it is converted to cash. Investors who depend on IRAs for their retirement income are advised against physical custody of gold.

Finding the Right Custodian

Investment brokerage firms and brick-and-mortar establishments, as well as some online firms, double up as custodians at no additional fee. However, not all of them support a bullion account. Bullion can be stored and handled by IRS approved depository firms. Trustees and custodians both work in the best interests of the investor. A trust owns and operates the account on behalf of the investor and has discretionary power to act upon the assets. Custodians, on the other hand, simply hold the assets for the investor and act solely as per the investor’s directions. Precious metal Individual Retirement Accounts do require an authentic and experienced trustee or custodian to deal with nuances of such investments.

Where Do You Start?

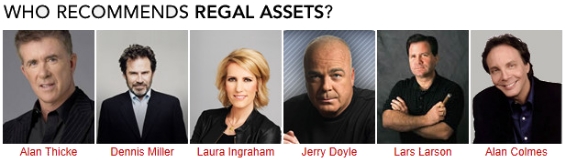

Each prospective company that buys and sells gold should be carefully checked for its credibility and trustworthiness. You want to deal with a reputable firm that is highly knowledgeable with the experience, expertise and resources to serve you in a professional manner. One such company is Regal Assets. With over 50 years of combined experience in the precious metals industry, they have a longstanding tradition of responsible and trustworthy business practices as demonstrated by a high A+ rating with the Better Business Bureau. Regal Assets is one of the largest and most trusted firms in North America specializing in gold and other precious metals, uniquely qualified to help all individual investors meet their investment objectives.

To learn more about securing your future with a Gold IRA, you may visit:

![]()

Claim Your Free Gold & Silver Investing Kit

(shipped to your front door completely free)