The Pros and Cons of Investing in Precious Metals

THE PROS AND CONS OF INVESTING IN PRECIOUS METALS

The prevalence of investing in precious metal as an income opportunity is becoming increasingly popular as people continue to seek ways to maximize their wealth. However, there are many pros and cons of investing in precious metals, with some being dependent on the type of investment one chooses. Additionally, these pros and cons may vary per situation, but there are general factors that one can look at in order to decide if it is wise to proceed.

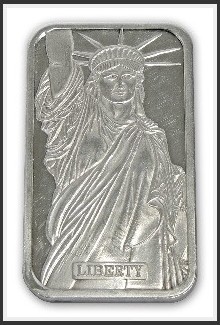

There are different ways of investing in rare metal. Investors can choose a physical or non-physical means of precious metals investment. Physical investments include bars, coins, rounds and allocated gold accounts. Non-physical investment options include trusts, units, unallocated accounts and exchange-traded funds – or ETFs. To the average investor, non-physical metals often provide the easiest way of becoming involved in the precious metals investing business.

One of the first things to note is that non-physical assets do not require storage. This is good because storage can cost money to either construct; a vault for example, or secure – as in the case of allocated accounts where the gold is stored by a third party and not the investor. Secondly, there are no concerns about transporting the product or worries about theft. Plus, the investor never has to worry about risks to life or limb.

Furthermore, investors who choose non-physical options are not concerned with the loss of craftsmanship value, as in the case of jewelry whenever liquidation takes place. Besides this, the investment is safe from fashion trends and high transaction costs. Moreover, an investor can choose the amount of a non-physical investment he or she wishes to liquidate at a given time. This is not the case with tangible investment options, such as a gold bar or a coin, since a fraction of a bar or coin cannot be liquidated.

On the other hand, non-material precious metal investments can be plagued by poor tracking when it comes to prices. Additionally, there is usually a yearly manager’s charge plus setup/initial charges in some cases (mainly with trusts and units). Simultaneously, each non-physical transaction carries its own manager’s fee which varies by company.

Another con for non-physical investors includes losing all claims to one’s investment. This is referred to as a “counterparty risk” and happens mainly in the case of unallocated account holders who contract a company that subsequently fails. When this occurs, the investor is viewed as a creditor as opposed to an investor so the metal cannot be reclaimed. There are also brokers’ trading fees and/or commissions to think about when holding non-material investments such as exchange-traded funds (ETFs).

As for the pros and cons of investing in precious metals, there is incidentally one factor that can be either, depending on the state of the market. It also extends to both material and intangible investments. This factor is the volatility of fine metals. Being volatile is good when prices are rising (a bull market) because investors can see the mild to rapid accumulation of profits in a matter of days. But it can also be detrimental to one’s portfolio in a bear market when prices are falling and investors are skeptical. Volatility is therefore one of the main reasons investors try to minimize the percentage of metals in their overall portfolio.